The Quarterly Checkup: Q3 2025 Market & VC Landscape

Published on December 15, 2025 · Written by Jason Robertson

Market Overview

The third quarter of 2025 may have marked a turning point for investors: markets stabilized after the turbulence of spring’s Liberation Day fiasco, inflation (temporarily) trended down before re-accelerating through the end of Q3, President Trump signed the One Big Beautiful Bill Act (OBBBA) and, the Federal Reserve had its first-rate cut in two years.

But what keeps me up at night (beyond my rambunctious new kittens) is that the current strength of the US economy and its stock markets – and by extension the global economy – is increasingly reliant on a single bet: the AI infrastructure buildout and the wealth effect it generates for the affluent. Investment in AI-related infrastructure such as data centers, software, and compute equipment, has become an outsized engine of US GDP growth, masking underlying weakness in other sectors. Experts suggest that without this massive capital expenditure boom, which some estimate contributed nearly half of all domestic demand growth in the first half of 2025, the economy might look recessionary. This concentration creates fragility. Crucially, the prosperity illusion created by this narrow boom directly feeds into consumption: the top 10% of households, who own 87% of all stocks, account for nearly 50% of total consumer spending in the US. This means that these households' willingness to spend is heavily dependent on the sustained buoyancy of the financial markets, particularly the elevated valuations of the "Mag 10" tech stocks driving the AI frenzy. If these AI equity valuations were to correct sharply, that paper wealth would evaporate, and the wealthiest cohort could dramatically reduce spending, giving the US economy severe whiplash, exposing the precarious foundation of the current growth cycle.

And yet I need to remind myself that many predicted the tech collapse in 1997 and that markets still went up another 60% before the dot.com crash in early 2000. What’s the moral? You can’t time the market. Perhaps more appropriate though from John Maynard Keynes: the markets can remain irrational longer than you can remain solvent (ask Michael Burry).

US Macroeconomic Landscape

The third quarter of 2025 signaled the first credible signs of macro stabilization in over a year for the U.S. economy, though ‘credible’ in today’s environment may be a generous word. On July 4, President Trump signed the One Big Beautiful Bill Act (OBBBA) into law, a sweeping fiscal and tax reform package that reshaped the environment for corporate investment and innovation. The OBBBA expanded the qualified small business stock (QSBS) exclusion, allowing investors to shield gains up to $15 million or 10× basis, and restored 100% R&D expensing, retroactively benefiting startups and venture-backed companies. It also launched a new $50 billion rural health transformation program (spending $10 billion annually from 2026-2030) aimed at strengthening healthcare infrastructure in underserved regions. For startups, this was arguably the most material policy tailwind since the 2017 tax cuts, but it arrived against the backdrop of already-stretched federal deficits and a volatile budget cycle. While the White House positioned the act as a pro-innovation measure, markets interpreted it as another round of fiscal stimulus that could complicate the Fed’s path toward price stability. Near term, it boosted sentiment; venture investors and corporates quickly modelled higher after-tax returns, but the longer-term implication is more ambiguous: additional debt issuance to fund these programs will likely pressure the long end of the yield curve as 2026 spending ramps.

Meanwhile, the tariff shock from April’s Liberation Day began to subside. After triggering a Q2 market selloff, Q3 saw no new trade escalations, and “the range of potential outcomes has narrowed,” reducing fears of an all-out trade war dragging the U.S. into recession. Tariffs nonetheless remained a headwind to growth: economists estimate full-year 2025 GDP will come in around ~2% which is in line with long-run trends but the slowest growth since the pandemic. Business confidence improved slightly from the tariff aftermath, but higher import costs and lingering uncertainty kept the economy on a sluggish footing. The labour market offered mixed signals as well. Unemployment hovered in the mid-4% range (around 4.3% by September), up from the cycle’s lows, with monthly job creation slowing to its weakest pace since early 2023. The President even replaced the head of the Bureau of Labour Statistics over the summer after jobs reports were released that he felt unfavourable, underscoring the political sensitivity around economic data.

On the monetary front, inflation remained above target and although it seemed to stabilize early in the quarter, it started increasing again at the end of Q3. This is unsurprising as experts expect inflationary tariff impacts to take 2-3 quarters to percolate through the system. Headline CPI averaged close to 3.0% year-on-year in Q3 2025 (2.9% YoY in August, 3.0% YoY in September), while core inflation held steady around 3.0%, elevated by tariff-related cost pressures but showing few signs of an inflationary spiral… yet.

This in combination with the deteriorating jobs data gave the Federal Reserve room to pivot toward easing: in September, the Fed delivered its first rate cut (25 bps) since the 2024 downturn, bringing the federal funds range to 4.00-4.25%. Policymakers signaled two more quarter-point cuts by year-end and another in January 2026, initiating a cautious easing cycle to support growth. Questions linger about Fed independence (the White House has been vocal about rate policy) and how massive fiscal deficits might drive up long-term yields. So far, however, bond markets have rallied: 10-year Treasury yields fell to ~4.15% by quarter-end from about 4.24% in June, while short-term yields declined more sharply as markets priced in further easing, moving “directionally in line with the Fed’s expected easing path”. Notably, small-cap stocks staged a sharp outperformance since July, an improvement that highlighted how falling rates can buoy previously lagging corners of the market.

The decline in yields helped equity markets in Q3 2025 deliver strong, quantifiable gains. The S&P 500 rose about 8.1% over the quarter, bringing its year-to-date return to 14.8% as of September 30. Meanwhile, the Nasdaq Composite surged roughly 11% in Q3, powered by continued enthusiasm for AI and resilient corporate earnings. Smaller, more rate-sensitive segments also participated: the Russell 2000 (small-cap index) returned roughly 12.4%, signaling that the rally was not limited to large-cap tech but extended to a broader set of equities. The equal-weight S&P 500 advanced 4.8%, trimming the gap with the cap-weighted index. Volatility also trended lower: the VIX averaged 16.9 for the quarter (down from 19.5 in Q2), and one-year rolling volatility sat around 20% for the S&P and 23% for the NASDAQ, signaling that investors were digesting rate-cut expectations rather than panicking about tariffs or growth.

In fact, a long-dormant exit route flickered back to life: the IPO window cracked open. A wave of tech listings in September yielded strong debuts. Companies like Figma, Firefly Aerospace, Gemini, and Netskope finally tested public markets, with solid receptions. The post-Labor Day period was especially active, with September being the busiest month for VC-backed IPOs since 2021. The performance of these debuts was generally strong (most priced at or above midpoint of their ranges, and saw healthy first-day pops), which in turn increased confidence among other late-stage companies and their backers. One prominent example is a design software firm Figma, which saw its stock soar ~250% on day one (however, this was followed by a significant correction, with the stock declining more than 50% over subsequent months as the broader market reassessed valuations). Still, this revival was selective. The companies that successfully reached the public markets in Q3 shared a common trait: strong fundamentals. Most were already profitable or operating close to breakeven, with business models anchored in essential or policy-favoured sectors (Figma’s profitability and AI-powered product suite set it apart). This represents a notable shift from the 2019-2021 IPO cycle, when high-growth but loss-making companies routinely debuted at premium valuations. Many late-stage startups remain unready for the public spotlight, prioritizing growth over earnings and thus “poor candidates for IPOs”. In 2025, investors have little appetite for speculative listings, and profitability has become the price of admission.

Geopolitically, federal priorities are increasingly shaping market dynamics. Q3’s largest offerings and investments clustered in areas aligned with the Administration’s agenda. For instance, several marquee IPOs – Firefly Aerospace (space), Gemini (crypto), and Netskope (cybersecurity) – all benefitted from policy tailwinds (e.g. defence contracts, pro-crypto legislation like the GENIUS Act) and each debuted at valuations $7-10B+. Washington’s focus on AI, defense, and “national champion” industries is clearly influencing where capital flows. The quarter ended with the U.S. government shutting down for forty-three days after Congress failed to pass a 2026 budget. Most federal agencies closed, pay for hundreds of thousands of workers was paused, and routine data releases stopped. Markets held steady overall, but the shutdown still shaved a few tenths off expected GDP growth for Q4. In short, Q3 closed on an uneasy note: inflation was easing and rates were falling, but Washington’s dysfunction reminded everyone how fragile the calm really is.

U.S. Venture Capital Landscape

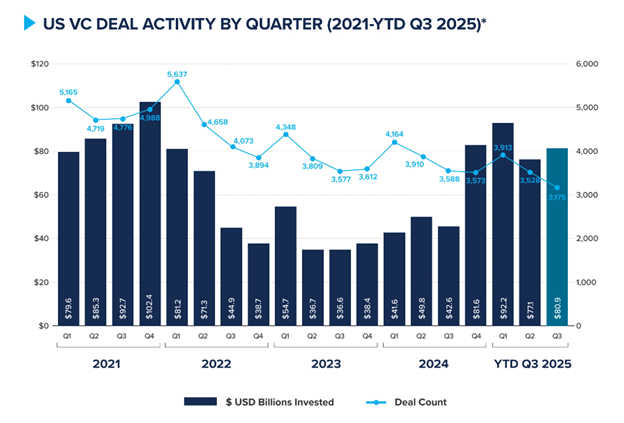

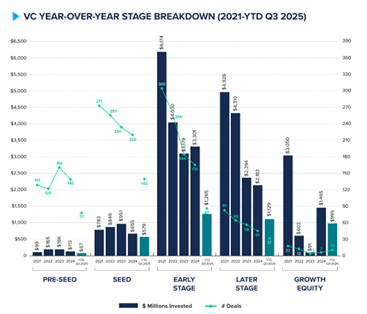

After a turbulent first half, U.S. venture capital activity picked up momentum in Q3 2025, but in a highly uneven fashion. By the numbers, VC dealmaking upticked slightly: venture firms deployed about $80.9 billion across ~4,208 deals in Q3, a 4.9% increase in value quarter-on-quarter. This marked one of the strongest quarters in recent memory and put 2025 on pace to exceed 2024’s totals. Under the surface, however, the market’s bifurcation only deepened. A handful of ultra-large financings dominated the quarter, while many smaller startups struggled to raise funds. Investors are concentrating firepower on what they perceive as “sure bets,” and the gap between the ‘haves’ and ‘have-nots’ in venture is widening.

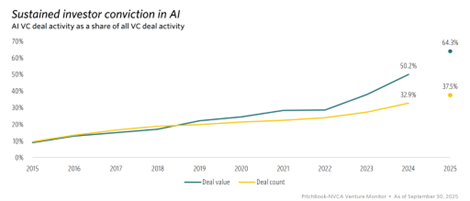

Two related themes defined U.S. venture in Q3: record-breaking AI investments and an investor flight to quality. Funding for AI/ML companies has reached unprecedented levels. Roughly 64% of all U.S. venture dollars this year have gone to AI-related startups, which make up only ~38% of deal count. Additionally, nine mega-financings of $1B+ closed during the quarter, accounting for nearly 40% of all Q3 venture capital by value. Most of these outsized rounds went to a few AI players. For instance, Databricks raised $1 billion in September at a valuation of roughly $100 billion, 61% higher than its previous round nine months earlier. Anthropic closed a massive $13 billion Series F, valuing the company at approximately $183 billion, nearly triple its valuation just 6 months prior. Likewise, xAI secured around $10 billion in a combined debt-and-equity deal in July, achieving a valuation near $75 billion, 50% above its late-2024 raise.

These deals illustrate the almost irrational exuberance around AI. Investors are effectively placing billion-dollar bets that these companies will eventually justify astronomic valuations. Naturally, this raises the stakes: as one VC quipped, when valuations climb ever higher, so too does the pressure for those businesses to deliver outsized returns to match. So far in 2025, VCs have been willing to tolerate that risk. They have averaged over 100 mega-deals per quarter, an astonishing cadence of big-ticket financings. Alongside AI, other sectors did see activity, but nothing on the same scale. Outside the AI frenzy, healthcare/biotech and fintech were among the largest destinations for capital (for context, in Q2 those sectors drew ~$14.8B and $10.8B respectively), though even these are increasingly intertwined with the AI narrative (e.g. AI-driven drug discovery, fintech AI models). In short, the story of 2025 venture capital is the story of AI. As one PitchBook analyst noted, “AI has driven venture capital growth [this year] despite liquidity shortages.” It has become the locus of both optimism and excess.

While capital floods the top end of the market, most startups face a far tougher fundraising environment. The data show a clear “flight to quality” by investors toward bigger, later-stage deals. Year-to-date, only ~50% of VC rounds have been under $5 million, down from ~75% in 2015, the lowest share in over a decade. One interpretation may be that the bottom half of the funding funnel (seed and modest Series A rounds) has constricted meaningfully; however, another interpretation may be that on an inflation-adjusted basis, sub-$1M and sub-$5M rounds are no longer sufficient at the earliest stages to build venture-scalable businesses. Alternatively, the decline of sub-$5M rounds may underscore the quality disparity and how selective venture funding has become – micro-startups are struggling to find backers, while investors pile into larger, “surefire” bets. Founders themselves are adjusting to this reality: able founders are raising larger rounds than they normally would, to extend runway and delay the next fundraise until conditions (hopefully) improve. This dynamic was evident in stage data: Series C and later rounds soaked up an outsized portion of capital, while seed activity flatlined. In Q2, later-stage VC (Series C+) totaled $55B (+53% YoY), whereas early-stage (Series A/B) was ~$26B (flat) and seed deal value was ~$10B (roughly flat, once a one-off $2B AI seed mega-deal is excluded). Q3 appears to have followed a similar pattern, only amplified by the mega-deal mania. The result is a barbell market: a glut of capital for a few winners, and a capital crunch for everyone else.

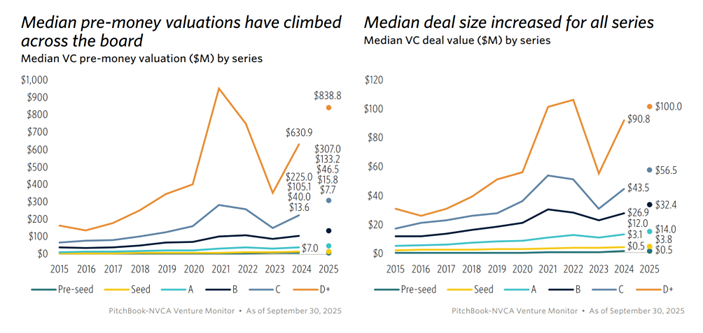

The valuation climate reflects these bifurcated trends. For the elite companies, valuations keep climbing to new heights. 2025 has seen median pre-money valuations increase across almost all stages, reaching ~$7M at pre-seed, ~$16M at seed, ~$46M at Series A, and over $130M at Series B (with later stages well into the hundreds of millions). At the same time, many less glamorous startups are accepting flat or down rounds, or surviving on convertible notes and venture debt to avoid price discovery.

Amid this challenging environment for many founders, one structural issue remains stubbornly unchanged: the gender gap in venture funding. Female-founded startups continue to face headwinds. Through Q3, companies with at least one female founder account for just ~21% of U.S. VC deals (down from 23% in 2024), and all-female founding teams have raised under 1% of total venture capital this year. By some measures, the share of deals going to all-female teams is at its lowest since 2015. In dollar terms, only ~$1.9B was invested in all-female teams through Q3. These dismal figures highlight that while overall VC activity is up in 2025, the industry’s inclusion problem has not improved, if anything, it has slightly worsened in this challenging fundraising period. Investors’ “flight to what (and who) they know” may be unintentionally exacerbating the gender funding disparity. Encouragingly, there are anecdotal bright spots (some women-led firms closing new funds, and a few high-profile female-founded startups securing large rounds), but the aggregate data underscore a continued imbalance.

Q3’s U.S. venture landscape showed renewed energy in headline numbers but with strong tones of selectivity. Total funding rebounded and even hit record highs in certain aspects (e.g. median deal sizes and mega-deal counts), yet this was driven by an extreme concentration of capital into the top echelon of companies, particularly those tied to AI. For the broad base of startups, 2025 remains a challenging fundraising climate marked by cautious investors, slow deal timelines, and an emphasis on evidence of traction. As we head into Q4, the big questions are whether the recent IPO successes will trickle down to improve sentiment for earlier-stage companies, and if the Fed’s easing and OBBBA’s tax breaks can revive risk appetite. So far, venture investors are sticking to a barbell strategy: double down on the winners, and wait out the rest.

Global Venture Capital Landscape

Worldwide venture funding reached an estimated $97 billion in Q3 2025, rising slightly from Q2 ($92 billion) and up 38% year-over-year. This marks the fourth consecutive quarter above the $90 billion level globally, suggesting a rebound in investment activity, but one driven overwhelmingly by massive late-stage financings. Capital has concentrated into a narrow set of outsized deals: roughly one-third of all VC dollars in Q3 went to just 18 companies that each raised $500+ million mega-rounds. Late-stage deal value surged to about $58 billion (approximately 60% of the total). By contrast, early-stage funding was roughly $30 billion globally (essentially flat, +10% YoY), and seed funding totaled around $9 billion, on par with Q3 2024 (excluding a record $2 billion seed outlier in Q2). In short, most of the capital this quarter poured into a handful of mature companies, as investors doubled down on perceived winners, while younger startups and smaller rounds continued to face a far tougher fundraising environment.

North America maintained its dominance in Q3, accounting for roughly two-thirds of global venture funding, a marked increase from about 58% a year ago. Heavily fueled by U.S. mega-deals (e.g., Anthropic’s $13 billion raise), investors put about $63 billion into U.S. and Canadian startups in Q3, over $20 billion more than the year-ago quarter. This concentration in North America far outstripped activity in other regions. Europe’s VC investment held steady at approximately $13.1 billion for Q3, flat quarter-over-quarter but ~22% higher year-over-year. Asia, meanwhile, saw muted funding levels. No Asian market produced a billion-dollar round this quarter, and the region’s largest deals (a $462 million raise by China’s EV maker FAW Bestune, a $348 million round by logistics firm GLP, and a $335 million round by rocket company Galactic Energy) were a magnitude smaller than the top Western rounds. Latin America remained only a minor contributor (roughly ~1% of global VC value), though total funding in LatAm inched up to about $1.0 billion in Q3 (an 8% QoQ and 21% YoY increase). This was driven by a rebound in late-stage activity in Brazil. Brazilian startups alone raised $692 million (up 92% QoQ) as the country regained its lead from Mexico, including a $160 million Series D for SaaS provider Omie, the region’s largest round of the quarter.

From a sector standpoint, investors’ focus in Q3 was squarely on AI. Companies building artificial intelligence models and platforms attracted roughly $45 billion, nearly 46% of all venture capital this quarter, with Anthropic alone accounting for about 29% of global funding. Beyond AI, the next-largest pool of capital went into technology infrastructure and hardware plays (from advanced chips and robotics to cloud, data center, and quantum computing startups), which collectively garnered about $16.2 billion. Healthcare and biotech was the third-largest category at approximately $15.8 billion, although biotech’s share of overall VC funding has now slumped to a multi-decade low. Financial services startups attracted around $12 billion globally, but many other verticals continued to lag. Sectors like cybersecurity and clean energy have seen funding retreat or stall relative to the AI frenzy. Compared to both last quarter and a year ago, the key theme is unchanged: capital is chasing a select group of late-stage, AI-driven companies, while most other sectors and early-stage ventures remain in a capital-constrained recovery.

US Digital Health Landscape

The digital health sector saw a steady but nuanced recovery in Q3 2025, building on positive momentum from the first half. U.S. digital health startups raised $3.5 billion in Q3 across 107 deals, bringing the year-to-date total to $9.9 billion across 351 deals. This means 2025’s funding is tracking ahead of last year: $9.9B through Q3 vs $8.4B in the same period of 2024, even though deal volume is down (351 rounds vs 504 in the first three quarters of 2024). In fact, the average digital health deal size has climbed to $28.1 million this year, a sharp increase from the $20.4M average in 2024. Larger checks and a handful of mega-rounds are propping up the totals, masking what is otherwise a somewhat thinner market in terms of deal count. Fewer startups are getting funded, but those that do are raising significantly larger rounds on average.

Investors’ interest in digital health remains strong but heavily concentrated. Q3’s $3.5B haul was on par with the previous quarter ($3.4B in Q2), and robust by historical standards: it’s about 30% higher than the average quarterly funding in 2023; however, the number of deals in Q3 (107) was the lowest of any quarter this year, continuing a downward trend (Q1 had 124 deals, Q2 had 120). Indeed, capital is increasingly concentrated in big bets: so far in 2025, there have been 19 rounds of $100M or more in digital health, already exceeding 15 such rounds in all of 2024. Q3 alone saw at least seven $100M+ financings, including standout raises like Strive Health’s $550M round, Judi Health’s $400M round, Ambience Healthcare’s $243M Series B, OpenEvidence’s $210M round, and Aidoc’s $150M round, among others. Collectively, these outsized Q3 deals accounted for roughly 39% of all digital health funding this quarter. In fact, just two companies, Strive and Judi, both focused on care delivery enablement, made up nearly $1B of the quarter’s total. The prevalence of these $100M+ deals means the “average” digital health startup in 2025 is quite atypical: many companies are still scraping by with seed or Series A checks in the low-single-digit millions, but the industry averages are boosted by a minority of firms raising nine-figure sums. This bifurcation between haves and have-nots mirrors the overall venture market. One positive interpretation is that investors still have high conviction in digital health’s winners, even as they prune their portfolios of smaller bets.

Digital health has become an ‘AI story’ as well. For the first time ever, AI-enabled startups captured a majority of digital health funding. An estimated 62% of U.S. digital health dollars in H1 2025 went to companies touting AI or machine learning in their solutions. We see that continuing in Q3: many of the largest raises were for AI-driven companies (e.g. Ambience for AI clinical documentation, OpenEvidence for AI in clinical trial evidence, Aidoc for AI-assisted radiology). The top-funded value propositions this year reflect this focus: clinical and non-clinical workflow automation startups have attracted 42% of all digital health funding in 2025, by far the highest share of any category. These include companies building AI tools to streamline clinician workflows, administrative processes, and data infrastructure, the unsexy backbone tech that can yield significant efficiency gains. Other areas include patient engagement and precision medicine, but it’s telling that the big dollars are chasing technologies that promise to reduce friction in healthcare delivery via automation.

This is not to say digital health is in a boom; rather, it’s steadying itself in a new normal. Beneath the headline figures, some undercurrents warrant caution. For one, the mid-stage pipeline has become murky. Startups are taking much longer to progress from early rounds to growth rounds. The Series B crunch seen in general VC is evident here too: only 30 digital health Series B rounds were completed through Q3, roughly half the typical volume by this point in recent years. Many young health tech companies that raised seed/Series A in the 2020-21 boom are still not “graduating” to Series B as fast. Also, as in other sectors, unpriced bridge rounds remain prevalent. Unlabeled insider extensions comprised ~35% of digital health deals this year, only a slight downtick from the peak usage of such rounds in 2023. This indicates that many startups (especially those that raised at high valuations) prefer a quiet top-up to slashing their valuation in a new priced round. The practice provides flexibility but also obscures true market pricing and can leave both founders and investors in uncertainty about a startup’s real stage.

On the liquidity front, Q3 2025 brought modest but meaningful signs of thawing for digital health, though the exit environment remains selective, not exuberant. The quarter saw 55 M&A exits, the highest number since the start of 2023, marking a visible uptick in consolidation among health-tech firms. That said, there were no major digital-health IPOs in Q3 itself, the last new public debuts came earlier in the year, when Hinge Health (musculoskeletal care) and Omada Health (chronic disease management) went public in May and June, respectively. Those earlier 2025 IPOs remain relevant: Omada raised ≈ $150 million and saw its shares jump ~21 % on debut, reflecting investor appetite for mature, revenue-backed care providers. Hinge Health, similarly, benefited from its profitability profile and positioning in employer-sponsored MSK care. Despite those successes, the broader outlook remains cautious. As of Q3, most of the 55 M&A exits were smaller seed / early-stage acquisitions rather than large strategic buys, and none moved the dial toward a “flood” of major exits for mid- or late-stage digital-health firms. This suggests what some call a “tapestry” of tuck-ins and smaller absorptions, rather than a multi-unicorn wave.

Canadian VC Landscape

Canada’s venture capital market in Q3 2025 displayed stability with a tilt towards larger financings, as investors navigated a transitioning environment. Canadian VCs invested $1.8 billion across 123 deals in Q3, bringing the year-to-date total to $4.9 billion over 386 deals. This represents a continued, gradual uptick each quarter ($1.4B in Q1, $1.7B in Q2, now $1.8B in Q3). By historical comparison, the first nine months of 2025 now exceed pre-pandemic norms in dollar terms (2017-2019 Q1-Q3 averaged ~$2.6-4.9B) while deal counts are roughly on par (slightly lower than the high end of that range). Canadian VC investment may have rebounded to slightly healthier levels, albeit via fewer deals, reflecting more capital per company. The average deal size in Q3 hit CAD $14.7 million, a ~20% jump from Q2. Aside from the aberrational 2021 bubble (when averages peaked around $18M), this quarter’s average deal size is among the highest on record for Canada. Canadian VCs, like their U.S. counterparts, are concentrating bets on the winners and later-stage opportunities.

The corollary of bigger deals is that deal counts have dipped, especially at the pre-seed andseed stage. Through Q3, pre-seed and seed rounds accounted for only about $650 million across 219 deals year-to-date. That is ~15% lower volume (in dollars and deal count) than the same period in 2024, and roughly equivalent to 2020’s subdued levels. Multiple factors are at play: tighter fundraising conditions for micro-VCs, many of whom haven’t been able to close subsequent funds; greater investor caution, leading angels and seed funds to reserve capital for follow-ons; and, a dip in new startup formation. On the last point, an estimated 800 tech startups were created in H1 2025 in Canada, down from ~1,100 in H1 2024 (though up from ~700 in H1 2023). Fewer new startups mean a thinner pipeline of pre-seed and seed deals. The end result is that Canada’s top-of-funnel has narrowed, even as total VC dollars invested remain high by historical standards. We continue to raise the alarm that this will present profound challenges to our Canadian venture ecosystem in a few years if not reversed. For now, later-stage activity is compensating. Canadian mega-deals ($50M+ rounds) have accounted for ~60% of all Canadian VC dollars in 2025. In Q3, several large financings boosted the tallies, including rounds by Toronto’s Cohere (a leading AI large-language-model startup), tax AI platform Blue J Legal, and Montreal-based AI video generator Moonvalley. Each of these deals injected tens of millions into a single company, propping up the aggregate investment figures. The dominance of a few big deals means the market’s strength is not uniform. For example, Québec saw a weaker Q3: only CAD $108M was invested across 23 deals in Quebec, which was a 63% drop in dollars from Q2 (partly because Q2 had some large Quebec deals). Ontario and BC, in contrast, pulled in the lion’s share of investment this quarter. Year-to-date, Ontario leads with ~$2.6B, followed by British Columbia (~$938M) and Québec (~$676M), which is a fairly typical distribution regionally. These three provinces collectively make up the bulk of VC activity in Canada, and that held true in 2025.

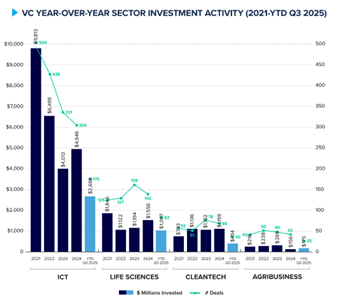

Sector-wise, Information and Communication Technology (ICT) remains the heavyweight, accounting for about 55% of all VC dollars (roughly $2.7B YTD) as Canada’s tech investments are still largely in software, AI, and digital platforms. A few niche sectors showed interesting movement: Agribusiness funding, at $175M YTD, has already exceeded its full-year 2024 total, indicating a surge of interest. Life sciences startups raised $1.07B YTD, putting that sector on track to roughly match last year’s total ($1.56B in 2024). Life sciences remain a strong pillar of Canadian VC, anchored by biotech hubs in Vancouver, Toronto, and Montreal with frequent participation from larger government-linked funds. In contrast, cleantech investment has pulled back significantly. By some accounts, 2025 is on pace to be cleantech’s lowest funding year in Canada since before the pandemic. With oil prices relatively stable and some cleantech companies struggling post-SPAC bust, investors appear less keen on green tech this year. Overall, though, the breadth of sector investment in Canada is reasonably balanced, with strength in AI and enterprise software (often under ICT), steady support for health/life sciences, and selective plays in other verticals.

A notable highlight for Canada in 2025 is the use of venture debt as a complement to equity financing. Through Q3, venture debt deals totaled $717M across 50 transactions, already almost doubling 2023’s full-year venture debt total of $436M. Many startups have tapped venture debt facilities to extend runway without taking a valuation haircut. However, venture debt cooled off by 35% in Q3 vs Q2. This may signal that as equity rounds (especially larger rounds) picked back up in Q3, fewer founders felt the need to seek debt, or it could simply be quarterly noise. Nonetheless, 2025 is on pace to be a record or near-record year for venture debt usage in Canada, reflecting founders’ cautious approach to dilution and the willingness of Canadian banks and funds to lend to tech companies when equity capital was scarcer. It’s a trend worth watching, as high leverage could pose risks if not managed, but so far it seems to have provided a helpful bridge for many companies.

On the exit and liquidity front, Canada remains in a holding pattern. There were no major VC-backed IPOs in Q3 (and indeed none YTD in 2025, the Canadian IPO window for tech startups has effectively been shut since mid-2022). The vast majority of exits have been via M&A, and mostly modest in size. Through Q3, CVCA tracked 30 venture-backed exits totaling CAD $1.2B, primarily acquisitions. That exit value is down about 25% from the same period last year, partly because 2021-2022’s lofty valuations have come down, reducing deal sizes, and partly because buyers remain a bit cautious. Still, the fact that 30 companies found exits is encouraging; it shows the “liquidity cycle remained functional” via acquisitions. Many of these exits were smaller tuck-ins, often with undisclosed terms. Canadian startups also saw some cross-border exits, with U.S. and international acquirers picking up niche Canadian tech (a trend that sometimes raises concern about domestic scale-ups being “picked off” too early). But given the global market conditions, any exit is a good exit from the perspective of LPs eager for distributions. The lack of IPOs remains a drag; venture LPs in Canada, as elsewhere, are waiting for the big payoffs from the 2020-21 boom vintages, and they haven’t materialized yet. Until the U.S. IPO window fully reopens and/or Canadian markets develop an appetite for growth tech IPOs, this status quo may persist.

Liquidity and VC Fundraising Outlook

A notable storyline in Q3 2025 was the reemergence of liquidity in the venture market. After several abnormally dry years, Q3 produced $74.5 billion in venture exit value across 362 deals, the strongest quarter for liquidity since the 2020-21 boom. In fact, the first three quarters of 2025 have already generated more exit value than the last three years (2022-2024) combined. IPOs in particular made headlines: seven venture-backed unicorns completed IPOs in Q3, a pace on par with earlier in 2025 and a far cry from 2022-2023, when unicorn IPOs were nearly nonexistent. Companies like Figma, Firefly Aerospace, Gemini, and Netskope finally tested public markets, with solid receptions.

The post-Labor Day period was especially active, with September being the busiest month for VC-backed IPOs since 2021. The performance of these debuts was generally strong (most priced at or above midpoint of their ranges, and saw healthy first-day pops), which in turn increased confidence among other late-stage companies and their backers. However, a key trend often saw these successful public listings priced meaningfully below their peak private market valuations (i.e., 'down rounds' for the public market) as public investors enforced a higher standard of financial discipline.

That said, the market’s enthusiasm has clear boundaries. The most successful IPOs tended to be companies that checked key boxes: profitable (or near it), beneficiaries of current policy tailwinds, or category leaders with compelling tech. For example, Firefly Aerospace went public at a ~$9.8B valuation (more than double its last private valuation), riding enthusiasm for space tech backed by defense funding. Crypto firm Gemini debuted at $7.1B after the passage of favorable legislation (the GENIUS Act) provided regulatory clarity. And Netskope’s September IPO at ~$7.3B underscored demand for cybersecurity solutions in line with national security priorities. These examples illustrate that the policy environment and profitability are driving a wedge in exit outcomes: those aligned with what public investors (and the government) favor can exit richly, whereas the many late-stage startups still “optimizing for growth over profitability” or carrying inflated legacy valuations remain on the sidelines.

Beyond IPOs, M&A activity also ticked up notably in Q3. Corporations and private equity buyers, who had been quiet in 2022-2023, started doing deals again. The quarter saw a number of >$500M acquisitions of VC-backed companies. 75% of VC acquisitions this year occurred at Series A or earlier, implying many are small exits, but there’s also been a “quiet increase” in buyouts of more mature startups by PE firms. In tech sectors like cybersecurity, enterprise AI, and robotics, consolidation is underway as larger players scoop up innovative startups to bolster their offerings. Overall, Q3’s improvement in exits provides a slight relief valve for the venture ecosystem. Notably though, it’s not a full return to the heyday: while 2025 is on track for the second-highest number of VC exits ever (after 2021), many of those exits are small, and valuations in exits are much lower than the peak, meaning modest outcomes for some investors. Plenty of companies are being acquired below their last private valuation (termed “dirty term sheet” acquisitions). Still, the psychological boost of seeing any IPOs and M&As cannot be overstated for LPs.

The ripple effect on limited partners (LPs) and venture fundraising is now coming into focus. Venture LPs endured a long period of minimal distributions. VC funds’ distribution rates were stuck in the low-single-digits (as a percentage of NAV) for 2022-2024, akin to GFC-era lows. This lack of liquidity led many LPs to pull back on new commitments. Now, with distributions beginning to improve, some LPs may regain capacity and confidence to recommit. However, it’s a slow turn. VC fundraising conditions in 2025 remained very challenging, and Q3 did not dramatically change that. Year-to-date through Q3, U.S. venture firms raised only $45.7 billion across 376 funds. The industry is on pace for the lowest annual fundraising total since 2017. For context, 2021 saw an all-time high (~$154B raised by U.S. VCs), and even 2022-23 were $85B+ years; 2025 might not reach much more than half of those levels.

Fewer funds are closing, and those that do take much longer. The median time to close a new VC fund has stretched to about 15.6 months (up from ~9.7 months in 2022). This means fundraising has become a year-plus endeavor for GPs, as LP due diligence drags out and many LPs simply defer making commitments. Of the cohort of venture firms that launched funds during the 2021-2022 boom (some 2,220 firms), only 30% (653 firms) have managed to raise a follow-on fund by now. In other words, 70% of newer VCs have not (yet) been able to raise their next fund. Many are stranded, still investing out of prior funds or scaling back. The venture industry is likely to see attrition in its ranks of managers, with only the stronger or more differentiated emerging managers surviving. Fundraising is heavily skewed to the top: the top 10 largest VC funds raised in 2025 captured about 42.9% of all capital, the highest concentration in at least a decade. LPs are writing big checks to a few brand-name firms and cutting back elsewhere, a classic flight to quality (or safety). Big, established firms like Andreessen, Sequoia, etc., have largely been able to refill coffers (though often at flat or slightly reduced fund sizes from their peak), whereas many mid-tier and newer funds are struggling.

The cautious stance of LPs is driven by a mix of factors: weak recent fund performance (DPI), overallocation to VC from the 2020-21 cycle, and competing opportunities in higher-yield assets given interest rate changes. Even though the exit environment perked up in Q3, the impact on LP liquidity will take time, distributions typically lag exits as shares unlock and M&A proceeds are disbursed. Thus, LP sentiment in Q3 remained lukewarm. Anecdotally, many institutional LPs (pensions, endowments) have been pressing pause on new VC relationships, focusing only on re-ups with their top performers. Family offices and non-traditional LPs have been somewhat more active (some seeing the downturn as a time to get into venture when entry valuations to funds might be better), but they’re smaller in aggregate. Another dimension is the rise of secondaries. With traditional exits delayed, GPs have increasingly turned to the secondary markets to provide liquidity. We’ve seen a boom in continuation funds (GP-led secondaries) where a VC fund sells some or all of its assets to a new vehicle to give LPs an out (or more time). Additionally, LPs themselves have been selling fund stakes on the secondary market to rebalance portfolios. Nearly 30% of all secondary transactions in the venture space this year have involved LP stake sales, as per industry reports, a huge jump from historical norms. The good news is that secondary markets are also providing a relief valve: they are an “alternative liquidity source” for those who need it, and the pricing on secondaries has improved (startups that in 2022 were trading at deep discounts in secondary sales have seen some price recovery in 2025, thanks to the public market uptick). The bad news (for GPs) is that many LPs who sell out in secondaries are not returning soon as primary investors.

From the GP perspective, pressure is on to show results. Venture firms know that to unlock fresh LP capital, they need to demonstrate distributions or at least significant markups. This has made some VCs more amenable to selling stakes in their portfolio companies (either to secondary buyers or via tender offers) to show DPI. It has also led to more VC-to-VC sales: one fund selling a stake in a company to another fund, and syndicate collaborations to generate partial exits. GPs are trimming their portfolios to focus follow-on dollars on the likely winners, rather than supporting every company, aiming to concentrate outcomes. All these behaviors reflect an industry in rationalization mode after the exuberance of 2021. One could say the venture market in late 2025 is resetting to a more sustainable baseline: exits are happening again but not at crazy valuations, funds are being raised again but not at breakneck pace, and LPs are committing again but with a discerning eye. Importantly, recent developments, the Fed easing, some high-profile exits, and the OBBBA’s investor-friendly tax provisions, provide grounds for slight optimism.

That said, recovery is a gradual climb. VC fundraising for new funds will likely continue to be “the have and have-nots” game into 2026. The big brand-name funds are in relatively good shape, many raised mega-funds in 2020-21 and are simply pacing themselves, and those coming back to market now are getting allocations (sometimes smaller than asked, but getting there). In contrast, hundreds of emerging managers may quietly wind down if they cannot secure commitments in the next 12-18 months. LPs are increasingly emphasizing quality of manager, track record, and discipline. They are also more interested in specialized strategies (e.g. AI-focused funds, secondary funds, or venture debt funds) as a way to play venture with less beta. We see, for example, “specialist emerging managers” finding some success by targeting niches – they often have smaller fund targets and very focused theses that can attract a loyal LP base despite the macro headwinds.

Looking Ahead

Q3 2025 provided a much-needed inflection point for liquidity in the venture ecosystem. The fact that we can talk about multiple IPOs, large M&A deals, and rising distributions again is a welcome change from the standstill of the past couple of years. This has begun to lift LP spirits cautiously, though LPs are still far from exuberant, they are at least seeing a path to eventual returns. Venture fundraising remains in a reset mode, on track for a cyclical low, but with strong incumbents continuing to attract capital. For LPs, the combination of improving exits and lower entry valuations (for both startups and funds) could make 2025-2026 vintages quite attractive, if they have dry powder to deploy. Many are still constrained, but those that can invest may look back on this period as a vintage of opportunity. The key will be patience: as one industry veteran noted, we’re “almost four years past the 2021 highs, and the liquidity crunch is really beginning to be felt”, meaning it took a while, but the pain of illiquidity forced change, and now that change (IPOs, M&As, secondaries) is starting to relieve the pain. Everyone – GPs, LPs, founders – will be watching Q4 and the upcoming 2026 election year closely. If the trends from Q3 continue (stabilizing macro, more exits, rationalized valuations), the venture market may well enter the new year with a sense of cautious optimism, having navigated through the hardest part of the downturn and into an era where fundamentals and discipline carry the day.